Use the following information for questions.

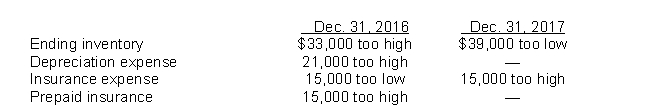

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:  In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Fairfax's working capital at December 31, 2017 is that working capital is understated by

Definitions:

Cognitive Processing

The mental actions or methods involved in acquiring knowledge and understanding through thought, experience, and the senses.

Concrete Elements

Physical components or parts that constitute the tangible structure of something, such as buildings or roads.

Early Maturation

Early maturation refers to the onset of puberty or the progression through developmental milestones at an earlier age than the typical range for one’s peer group, which can impact psychological and social adjustment.

Socially Approved Activities

Actions or behaviors that are accepted and valued by a society or community.

Q19: Which of the following is not a

Q22: If the preferred shares are noncumulative and

Q35: A company using a perpetual inventory system

Q37: The IASB permits which of the following

Q47: A sale-leaseback transaction is<br>A)a lease that has

Q51: Under a (non-compensatory)employee stock option plan (ESOP),

Q52: Convertible bonds<br>A)have priority over other indebtedness.<br>B)are usually

Q55: Non-accumulating rights to benefits, such as parental

Q81: The revenue recognition principle indicates that revenue

Q107: Norton Company issues 4,000 shares of its