Use the following information for questions.

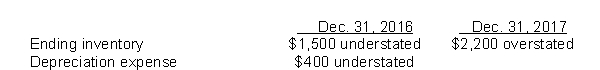

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on Cheyenne's 2017 net income?

Definitions:

Assembly Department

A section within a manufacturing facility where components are assembled into final products, often involving both human labor and machinery.

Direct Method

A costing method that directly allocates service department costs to producing departments without apportioning them among the service departments themselves.

Support Departments

Units within an organization that provide essential services and support to the main production or operational departments but do not directly contribute to the primary business product or service.

Machining Department

A specific department within a manufacturing facility where machining processes such as cutting, drilling, or milling are performed on materials.

Q6: Accounting issues involved for unincorporated businesses include<br>A)the

Q8: Who assumes the economic risk for defined

Q17: On December 31, 2010, Gledhill, Inc.sells production

Q21: What is the total effect of the

Q38: On November 1, 2017, Best Corp.signed a

Q43: A lessee reported a ten-year capital lease

Q46: Under ASPE, if land is the sole

Q49: During calendar 2017, Marcellus Inc.sold equipment for

Q66: In computing diluted earnings per share, share

Q74: Derivatives exist to help companies<br>A)hide financial irregularities.<br>B)reduce