Use the following information for questions.

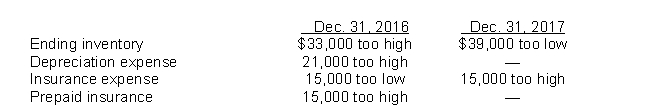

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:  In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Fairfax's working capital at December 31, 2017 is that working capital is understated by

Definitions:

Intercalated Disc

Specialized connections between cardiac muscle cells containing gap junctions and desmosomes, facilitating unified contractions of the cardiac tissue.

Cardiac Muscle Fiber

A type of involuntary striated muscle found in the walls of the heart, enabling it to contract and pump blood throughout the body.

Striation

A series of ridges, furrows or linear marks, often found in muscle tissues or rocks.

Ligamentum Arteriosum

A small ligament that is a remnant of the ductus arteriosus, connecting the pulmonary artery to the descending aorta in the fetal circulation system.

Q9: Compensation expense resulting from a compensatory share

Q10: Palmer Co.had a deferred tax liability balance

Q26: Using the revenue approach of accounting for

Q26: A reclassification adjustment is necessary when a

Q35: Aluminum Ltd.has made a total of $23,250

Q37: On January 1, 2017, Lace Ltd.sold five

Q43: At issuance, the cash proceeds from the

Q53: In a troubled debt restructuring in which

Q68: Sukwinder Corp.manufactures equipment for sale or lease.On

Q120: How should cumulative preferred dividends in arrears