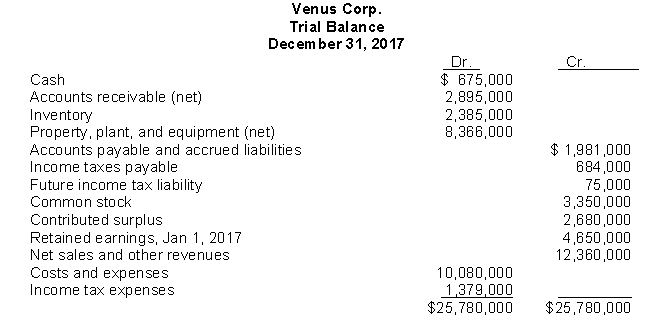

Use the following information for questions.

Venus Corp.'s trial balance at December 31, 2017 is properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2017:

Other financial data for the year ended December 31, 2017:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2019.

The balance in the future income tax liability account relates to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.The current and future tax rate on all types of income is 35 percent.

-In Venus's December 31, 2017 statement of financial position, the current assets total is

Definitions:

Antonio Negri

An Italian Marxist sociologist and political philosopher known for his co-authorship of "Empire," which examines global capitalism and its networks of power.

Appadurai's Landscapes

Refers to Arjun Appadurai's conceptual framework on the fluid, dynamic global cultural flows categorized into five dimensions: ethnoscapes, technoscapes, financescapes, mediascapes, and ideoscapes.

Nation-States

Politically sovereign entities characterized by a defined territory, permanent population, a government, and the capacity to enter into relations with other states.

Disjunctures

Points of disruption or disconnection in societal, cultural, or technological systems, where expected flows or relationships are broken.

Q19: Free cash flow is calculated as net

Q21: If a unit of inventory has declined

Q24: Unusual gains and losses are items on

Q29: The interest element for trade receivables<br>A)is usually

Q32: An accrual basis employer may take a

Q42: At the end of 2017, its first

Q55: A manufacturer that carries very little inventory

Q62: Which of the following statements is INCORRECT

Q62: The objectives of disclosures required for investments

Q79: The strict cash basis of accounting<br>A)records revenue