Use the following information for questions.

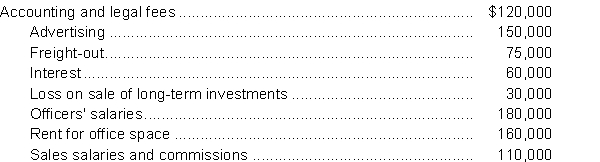

Oskar Corp.reports operating expenses in two categories: (1) selling and (2) general and administrative.The adjusted trial balance at December 31, 2017, included the following expense accounts:  One-half of the rented premises is occupied by the sales department.

One-half of the rented premises is occupied by the sales department.

-How much of the expenses listed above should be included in Oskar's selling expenses for 2017?

Definitions:

Higher-income Persons

Individuals or households that have an income significantly above the average for a certain society or area.

Taxes

Mandatory financial charges imposed by a government on individuals, businesses, and transactions to fund public expenditures.

Progressive Tax

A taxation system where the tax rate increases as the taxable amount (income or wealth) increases, aiming to achieve a more equitable distribution of wealth.

Tax Structure

The composition and design of tax rates, brackets, and policies within a particular tax system.

Q16: The exercise of professional judgement does NOT

Q18: Reasonable compensation paid to owners (other than

Q21: An example of a temporary account is<br>A)Unearned

Q29: How much of the expenses listed above

Q36: Capital losses in excess of the annual

Q39: Which of the following is not considered

Q44: If the beginning 2017 balance in the

Q52: Which of the following statements is INCORRECT

Q64: In preparing its bank reconciliation at April

Q76: Which of the following is a reason