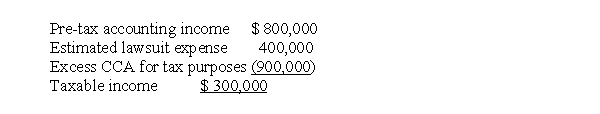

At the end of 2017, its first year of operations, Gaucho Corp. prepared the following reconciliation between pre-tax accounting income and taxable income:  The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

The estimated lawsuit expense of $400,000 will be deductible in 2018 when it is expected to be paid. Use of the depreciable assets will result in taxable amounts of $300,000 in each of the next three years. The income tax rate is 25% for all years. Gaucho adheres to IFRS requirements. The deferred tax asset to be recorded is

Definitions:

Organizational Commitment

The emotional attachment, identification, and involvement that an employee has with their organization and its goals.

Stakeholder Orientation

A business strategy that considers the interests and needs of everyone who has a stake in the company, including customers, employees, shareholders, and the community.

Feedback

A response provided to input or performance, often aimed at improvement or adjustment.

Special-Interest Groups

Organizations comprised of members sharing common interests or goals that seek to influence public policy and decision-making processes.

Q17: P, a single individual, purchased a new

Q18: The first step in the revenue recognition

Q19: T purchased a 60 percent interest in

Q21: In Canada, the body which is NOT

Q27: A post-closing trial balance<br>A)includes temporary accounts only.<br>B)includes

Q33: Mr.and Mrs.T have one dependent and file

Q41: In Venus's December 31, 2017 statement of

Q41: In the absence of specific GAAP guidance,

Q46: Casey Inc. uses the accrual method of

Q55: Which of the following is(are)NOT recommended to