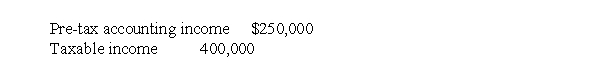

Gretna Corp. reported the following results for calendar 2017, its first year of operations:  The difference between accounting income and taxable income is due to a temporary difference, which will reverse in 2018. Assuming that the enacted tax rates in effect are 30% in 2017 and 25% in 2018, what amount should Gretna record as the deferred tax asset or liability for calendar 2017?

The difference between accounting income and taxable income is due to a temporary difference, which will reverse in 2018. Assuming that the enacted tax rates in effect are 30% in 2017 and 25% in 2018, what amount should Gretna record as the deferred tax asset or liability for calendar 2017?

Definitions:

Homogeneous Products

Goods that are perfectly identical in quality, size, and features, making them indistinguishable to consumers from multiple producers.

Luxury Yachts

Luxury yachts are high-end, luxurious boats that are often equipped with sophisticated amenities and are used for personal or commercial pleasure.

Cartel Members

Firms or countries that collaborate to control prices and production in an industry, acting together rather than competing, often to maximize collective profits.

Cartel Members

Individuals or entities that form an agreement to control prices and limit competition within a market.

Q11: C, a single mother, has modified AGI

Q15: As of 2011, the responsibilities of the

Q21: A reconciliation of Quebec Corp.'s pre-tax accounting

Q21: R's personal sailboat is destroyed in a

Q26: A good method to generate tax credits

Q31: There is never any depreciation recapture on

Q34: In which transaction did the donor/seller not

Q37: For 2015, what amount should Horn recognize

Q51: Which of the following balance sheet classifications

Q75: Which of the following statements regarding the