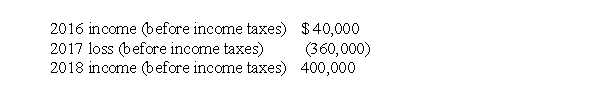

Hopper Corporation reported the following results for its first three years of operations:  There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If Hopper elects to use the carryback provisions, what income (loss) is reported for 2017?

There were no permanent or reversible differences during these three years. Assume an income tax rate of 30% for 2016 and 2017, and 40% for 2018, and that any deferred tax asset recognized is more likely than not to be realized. If Hopper elects to use the carryback provisions, what income (loss) is reported for 2017?

Definitions:

Financial Asset(s)

Financial assets refer to any assets that are cash, an ownership interest in an entity, or a contractual right to receive or deliver cash or another financial instrument.

Cryptocurrencies

Digital or virtual currencies that use cryptography for security and operate independently of a central bank, enabling secure, anonymous transactions.

Blockchain

A decentralized digital ledger technology where transactions are recorded with an immutable cryptographic signature called a hash.

Q10: H's house was flooded this year due

Q13: Federal income taxes related solely to the

Q17: When a company disposes of a discontinued

Q26: The importance of stock being designated §

Q28: Pluto Corp.'s trial balance included the following

Q28: Which of the following serves as the

Q28: When a company sells a bundle of

Q39: When a contract becomes unprofitable to an

Q54: Concessionary or abnormal terms may<br>A)reflect that risks

Q55: G is a single, calendar year, individual