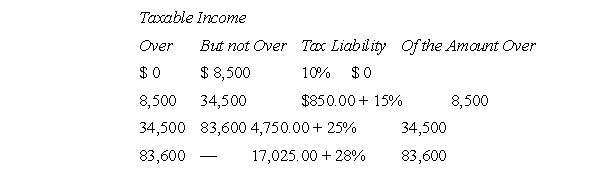

H is a single, calendar year, individual taxpayer.She has taxable income for the year 2011 of $70,000, including a net short-term capital gain of $5,000 and a net long-term (15 percent) capital gain of $30,000.The 2011 tax schedules for single taxpayers are as follows:  H's federal gross income tax for 2011 is

H's federal gross income tax for 2011 is

Definitions:

High Capital Requirements

The need for significant financial investment to start or maintain operations in certain industries or business activities.

Limited Distribution Channels

A situation where a product or service has a small number of outlets or platforms through which it can reach customers.

Industry Analysis

An examination of the economic and market forces that affect the competitiveness within an industry.

High Exit Barriers

Factors that make it difficult and costly for a company to leave a market or industry.

Q10: Where there is no intent to demolish

Q13: S receives incentive stock options (ISOs) as

Q21: An example of a temporary account is<br>A)Unearned

Q23: For the current year, a taxpayer had

Q34: Section 1033, dealing with involuntary conversions, is

Q39: Valuing assets at their liquidation values rather

Q42: T purchased the following lots of

Q48: Which of the following is NOT part

Q48: Which of the following is not true

Q56: This year T sold his interest in