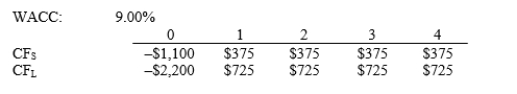

Nast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Nash Equilibrium

A concept within game theory where each player's strategy is optimal, given the strategies of other players, and no player has anything to gain by changing their own strategy alone.

Dominant Strategy

A strategy in a game theory context that is best for a player regardless of what strategies other players choose.

Nash Equilibria

Situations in a strategic game where no player can benefit by changing their strategy while the other players keep theirs unchanged.

Stable

In an economic context, it refers to a situation or condition that is not significantly changing or is predictable and thus not subject to rapid fluctuations.

Q9: In order to accurately assess the capital

Q43: Zeta Software is considering a new project

Q44: A "Canada call" in corporate bonds is

Q44: Which of the following statements best describes

Q47: Flint Fruits is considering two equally risky,

Q56: The component costs of capital are based

Q78: A firm's financial risk has identifiable market

Q82: Your portfolio consists of $50,000 invested in

Q82: You are considering two equally risky annuities,

Q108: Listed below are some provisions that are