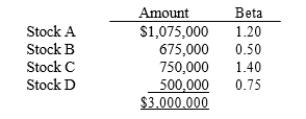

Assume that you are the portfolio manager of the Coastal Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 14.00% and the risk-free rate is 6.00%. What rate of return should investors expect (and require) on this fund?

Definitions:

Diffusion

A method where a new idea is spread via specific pathways over a period among individuals within a societal structure.

Substantial Diffusion

The wide and significant spread of ideas, practices, or innovations across a large population or area.

Complex Innovations

Innovations that involve multiple interdependent elements and changes, requiring comprehensive understanding and adaptability for successful implementation.

Diffuse

To spread or disperse something widely, or to become less concentrated or focused.

Q1: The coefficient of variation, calculated as the

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1784/.jpg" alt=" A) Sensitivity analysis

Q7: Yonan Inc. is considering Projects S and

Q9: In order to accurately assess the capital

Q20: Assume that you are on the financial

Q22: The first, and most critical, step in

Q46: Bey Bikes is considering a project that

Q53: A share of common stock has just

Q54: Although a full liquidity analysis requires the

Q100: A small manufacturer is considering two alternative