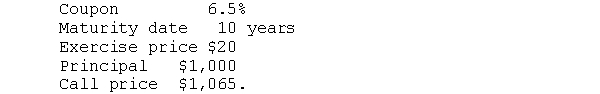

A firm has both a convertible bond and a convertible preferred stock outstanding. The convertible bond has the following features:  The convertible preferred stock has the following features:Annual dividend $2.25Convertible into 2.5 shares of common stockCallable at $25 a share.Currently the common stock is selling for $13; the yield on non convertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock What would be the value of each security if it lacked the conversion feature SOLUTIONS TO THE PROBLEMS

The convertible preferred stock has the following features:Annual dividend $2.25Convertible into 2.5 shares of common stockCallable at $25 a share.Currently the common stock is selling for $13; the yield on non convertible bonds is 10%, and the yield on comparable preferred stocks is 14%. What is the value of the above securities in terms of the common stock What would be the value of each security if it lacked the conversion feature SOLUTIONS TO THE PROBLEMS

Definitions:

Natural Stain

A discoloration or marking often found on materials, caused by the chemical or physical reaction of a natural substance.

Fractures

Breaks or cracks in rocks where there has been no significant movement or displacement of the sides relative to one another.

Slope-forming Unit

A layer of rock or sediment that determines the slope or steepness of a geological formation due to differences in strength, erosion, or weathering rates.

Loose

Describes materials or objects that are not tightly fixed or compact, allowing for easy movement or separation.

Q10: Calculation of the returns earned on a

Q13: Stock dividends cause<br>A) the price of a

Q18: Given the information below, answer the following

Q20: Long dark candlesticks suggests<br>A) stock prices changed

Q21: A $50 par value convertible preferred stock

Q43: A convertible bond's payback period1. increases as

Q47: The premium paid over a convertible bond's

Q56: Which of the following would be added

Q68: With this method, there is no allowance

Q173: After a bank reconciliation is completed, journal