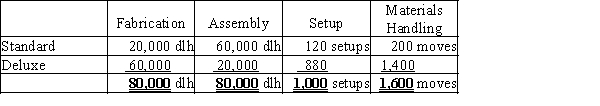

Canine Company has total estimated factory overhead for the year of $2,400,000, divided into four activities: fabrication, $1,200,000; assembly, $480,000; setup, $400,000; and materials handling, $320,000. Canine manufactures two products, Standard Crates and Deluxe Crates. The activity-base usage quantities for each product by each activity are as follows:  Each product is budgeted for 20,000 units of production for the year.Determine

Each product is budgeted for 20,000 units of production for the year.Determine

(a) the activity rates for each activity and

(b) the factory overhead cost per unit for each product using activity-based costing.

Definitions:

Reacquisition

The process of buying back or otherwise regaining possession of something previously sold, lost, or given away.

Instrument

A formal legal document, such as a contract, will, bond, lease, or loan, that establishes legal rights and obligations.

Negotiation

A bargaining process in which disputing parties interact informally to attempt to resolve their dispute. Also, the transfer of the rights to a negotiable instrument from one party to another.

Liability

The state of being responsible for something, especially in terms of legal or financial obligations that may arise from actions or transactions.

Q31: In an investment center, the manager has

Q35: A six-year project is estimated to cost

Q67: Depreciation expense on store equipment for a

Q69: The Central Division of Chemical Company has

Q101: On June 1, the cash account balance

Q126: Most manufacturing plants are considered cost centers

Q128: Which of the following is not an

Q134: Income from operations divided by invested assets<br>A)Controllable

Q162: Which of the following errors, each considered

Q174: McNally Industries has a condensed income statement