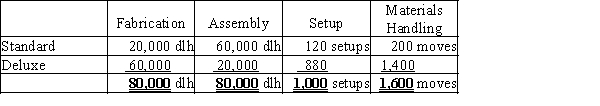

Canine Company has total estimated factory overhead for the year of $2,400,000, divided into four activities: fabrication, $1,200,000; assembly, $480,000; setup, $400,000; and materials handling, $320,000. Canine manufactures two products, Standard Crates and Deluxe Crates. The activity-base usage quantities for each product by each activity are as follows:  Each product is budgeted for 20,000 units of production for the year.Determine

Each product is budgeted for 20,000 units of production for the year.Determine

(a) the activity rates for each activity and

(b) the factory overhead cost per unit for each product using activity-based costing.

Definitions:

Accord And Satisfaction

A legal contract wherein parties agree to a settlement that conclusively resolves a dispute or debt.

Forbearance To Sue

An agreement to refrain from filing a lawsuit as part of a negotiation or compromise, despite having grounds for legal action.

Employee Handbook

A comprehensive manual provided by employers to employees, detailing job-related information, policies, and procedures.

Mutual Consent

An agreement or decision made jointly by two or more parties with both or all agreeing voluntarily.

Q18: The cost per unit for the production

Q30: The budget for Department 6 of Cardinal

Q55: The desired selling price for a product

Q105: The ratio of income from operations to

Q110: If income from operations for a division

Q121: Constraint<br>A)Demand-based concept<br>B)Competition-based concept<br>C)Product cost concept<br>D)Target costing<br>E)Production bottleneck

Q122: The return on investment may be computed

Q124: John Smith, Capital<br>A)Credit side<br>B)Debit side

Q130: Rental charges of $40,000 per year plus

Q166: How much will Division A's income from