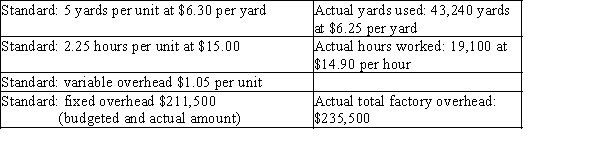

Prepare an income statement for the year ended December 31, through the gross profit for Baxter Company using the following information. Baxter Company sold 8,600 units at $125 per unit. Normal production is 9,000 units.

(Do not round fixed overhead rate calculation when determining fixed factory overhead volume variance.)

Definitions:

Fixed Costs

Expenses that do not change with the level of production or sales, such as rent, salaries, and insurance.

Contribution Margin

The difference between sales revenue and variable costs, representing the amount that contributes towards covering fixed costs and generating profit.

Weighted Average

A calculation that takes into account the varying degrees of importance of the numbers in a data set, used in financial analysis and grading.

Fixed Expenses

Recurring costs that do not fluctuate with the level of production or sales volume, such as lease payments or salaries.

Q3: Manley Co. manufactures office furniture. During the

Q10: Peyton Company manufactures Phone X and Phone

Q21: Hummingbird Company uses the product cost concept

Q27: The following data relate to direct labor

Q44: Using the FIFO method and rounding cost

Q110: If income from operations for a division

Q112: The Bottling Department of Mountain Springs Water

Q172: Evaluation of how income will change based

Q209: Piper Technology's fixed costs are $1,500,000, the

Q210: A disadvantage to using the residual income