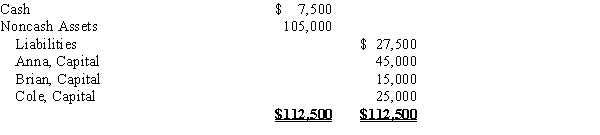

After discontinuing the ordinary business operations and closing the accounts on May 7, the ledger of the partnership of Anna, Brian, and Cole indicated the following:  The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

The partners share net income and losses in the ratio of 3:2:1. Between May 7 and May 30, the noncash assets were sold for $150,000, the liabilities were paid, and the remaining cash was distributed to the partners.

(a)Prepare a statement of partnership liquidation.

(b)Assume the same facts as in

(a), except that the noncash assets were sold for $45,000 and any partner with a capital deficiency pays the amount of the deficiency to the partnership. Prepare a statement of partnership liquidation.

Definitions:

Legal Liability

The state of being legally responsible for something, such as a debt or obligation.

Third Party

An entity or individual who is not directly involved in a transaction or legal matter but may be affected by it.

Offer

A proposal presented by one party to another as a basis for negotiations or forming a contract.

Legal Liability

Refers to being legally responsible for damages or enforcement actions, arising out of one's actions or omissions under the law.

Q17: On July 8, Jones Inc. issued an

Q42: Capital expenditures are costs that improve a

Q50: Which of the following taxes are employers

Q56: The following information was taken from

Q58: On December 31, Strike Company has decided

Q58: According to a summary of the payroll

Q81: Gain on Sale of Equipment<br>A)Current assets<br>B)Fixed assets<br>C)Intangible

Q106: Hall Company sells merchandise with a one-year

Q143: After discontinuing the ordinary business operations and

Q216: When a company sells machinery at a