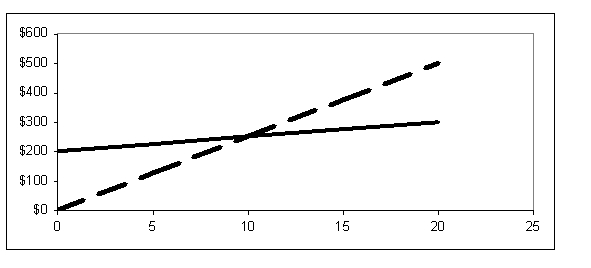

Data extracted from the accounting information system of Turner Corporation produced the following graph. The equation of the dashed line is y = $25x; the equation of the solid line is y = $200 + $5x.  The point where the dashed line intersects the solid line is the:

The point where the dashed line intersects the solid line is the:

Definitions:

Modified AGI

Adjusted Gross Income (AGI) with certain adjustments added back in, often used in tax calculations to determine eligibility for certain tax benefits.

Married Filing Joint

A filing status on U.S. tax returns allowing married couples to combine their incomes, deductions, and credits on a single tax return, potentially leading to tax benefits.

American Opportunity Tax Credit

A credit that allows qualifying students or their parents to reduce their federal income tax based on education expenses paid.

Modified AGI

Adjusted Gross Income with certain deductions added back in, used for determining eligibility for specific tax deductions and credits.

Q11: The subscript before the symbol for an

Q28: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7291/.jpg" alt=" The total binding

Q35: Textbook costs are an opportunity cost of

Q38: FCS Corporation sells its single product for

Q49: If an organization cannot deliver goods or

Q52: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7291/.jpg" alt=" The graph shows

Q70: Which of the following is the most

Q71: Quick Start Engines has two departments,

Q73: In gamma decay a nucleus in an

Q121: The total cost of Job No. 175