Angela Smith has owned and operated The Stationary Store for fifteen years. The company's year-end is December 31st.

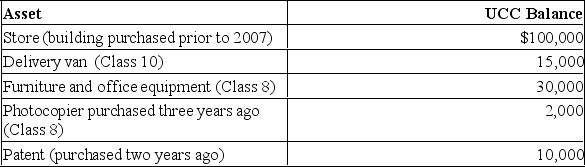

Assets owned prior to 20x0 and their UCC balances on January 1, 20x0 are listed below:

Additional information for 20x0:

Additional information for 20x0:

Angela purchased $2,000 worth of small tools (each costing under $500).

The delivery van was sold for $12,000. The original cost was $20,000. A second-hand van was purchased in the year for $16,000.

$15,000 was paid for an air conditioning system in the building, which was added to the cost of the standard Class 1 pool.

Angela sold the photocopier for $1,500 in the year, and will replace it in January, 20x1 with a second-hand model valued at $1,700.

Angela amortizes the patent in Class 44.

The business acquired a franchise on March 1st of 20x0 costing $55,000. The franchise has a limited legal life of 20 years. (Ignore leap year effects.)

Required:

A) Calculate the following:

(Assume 20x0 is 2019.)

1) the total CCA that Angela will be able to claim in 20x0;

2) the UCC balances as of December 31, 20x0;

3) any recapture and/or terminal loss that occurred during the year.

B) What would the tax effect have been for the original photocopier if Angela had purchased the new photocopier during 20x0?

Definitions:

Stimulus Level

The intensity of a stimulus which may influence the response it elicits from an organism or process.

Just Noticeable Difference

The smallest change in the intensity of a stimulus that can be detected.

Weber's Law

A principle in psychology stating that the just-noticeable difference in a stimulus is proportional to the magnitude of the original stimulus.

Opponent-Process Principle

A psychological and physiological model that explains contrasting emotional and sensory responses to stimuli.

Q2: Which of the following lists are acceptable

Q7: Which of the following is FALSE regarding

Q12: Which of the following equations best describes

Q32: When an acid is dissolved in water,

Q66: For naming purposes, which carbon is the

Q71: What happens in the retina as a

Q78: Is gasoline, which is nonpolar, miscible with

Q86: Why do saturated fats have higher melting

Q87: Ogleby Inc.'s accounting records reflect the

Q111: Which statement does NOT correctly explain why