(Adapted from "Problem Eleven" from Chapter Six of previous editions of the textbook)

Alpha Ltd. is a Canadian-controlled private corporation operating a small land-development business. In June 20x2, the company acquired a license to manufacture pre-fab homes and began operations immediately. Financial information for the 20x2 taxation year is outlined below:

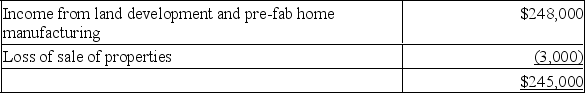

Alpha's profit before income taxes for the year ended November 30, 20x2, was $245,000, as follows:

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

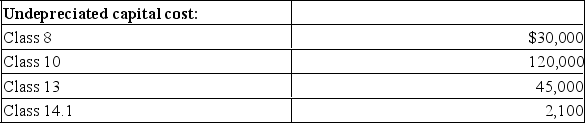

The 20x1 corporate tax return shows the following UCC balances:

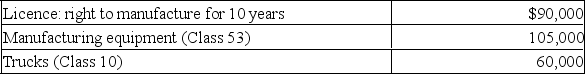

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Accounting amortization in 20x2 amounted to $60,000.

Accounting amortization in 20x2 amounted to $60,000.

Alpha normally acquires raw land, which it then develops into building lots for resale to individuals or housing contractors. In 20x2, it sold part of its undeveloped land inventory to another developer for $400,000. The sale realized a profit of $80,000, which is included in the land-development income above. The proceeds consisted of $40,000 in cash, with the balance payable in five annual instalments beginning in 20x3.

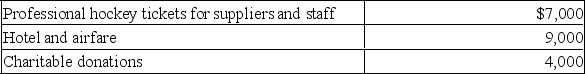

Travel and entertainment expense includes the following:

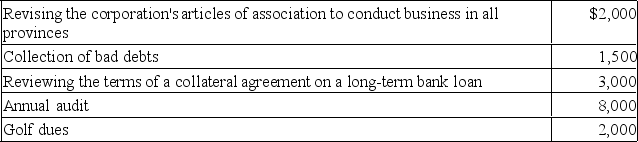

Legal and accounting expense includes the following:

Legal and accounting expense includes the following:

Required:

Required:

Calculate Alpha's net income for tax purposes for the 20x2 taxation year. (Assume 20x2 is 2019.)

Definitions:

Male Line

The lineage or descent traced through the male members of a family or group.

Descent

The lineal lineage or ancestry from ancestors, often used in reference to the transmission of cultural or genetic inheritance.

Kinship System

The network of social relationships that form an important part of the cultures of most societies, often based on blood relations, marriage, or adoption.

Fewest Number

The smallest quantity or count in a set or group of objects, people, or entities.

Q2: Tom and Bob are equal shareholders of

Q3: Which of the following statements is TRUE

Q5: Agatha earned $35,000 at her job during

Q7: Steven Co. is a public Canadian corporation

Q7: With respect to GST/HST, supplies fall under

Q13: Which of the following alcohols are found

Q23: Which of the following statements does NOT

Q44: Barton Company has beginning work in process

Q87: Ethanol dissolving in water is an example

Q88: Can adrenaline form hydrogen bonds, and if