(Adapted from "Problem Eleven" from Chapter Six of previous editions of the textbook)

Alpha Ltd. is a Canadian-controlled private corporation operating a small land-development business. In June 20x2, the company acquired a license to manufacture pre-fab homes and began operations immediately. Financial information for the 20x2 taxation year is outlined below:

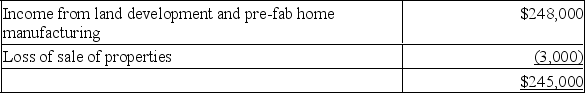

Alpha's profit before income taxes for the year ended November 30, 20x2, was $245,000, as follows:

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

The loss on sale of property resulted from two transactions. On October 1, 20x2, Alpha sold all of its shares of Q Ltd., a 100% subsidiary, for $100,000. (The shares were acquired seven years ago for $80,000.) Also, during the year, Alpha sold some of its vehicles for $25,000. The vehicles originally cost $50,000 and had a book value of $48,000 at the time of sale. New vehicles were obtained under a lease arrangement.

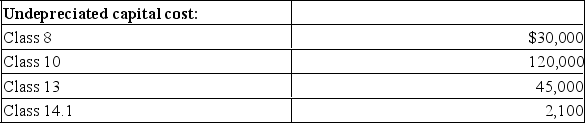

The 20x1 corporate tax return shows the following UCC balances:

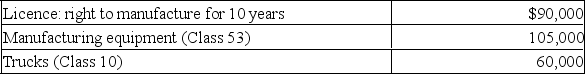

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Alpha occupies leased premises under a seven-year lease agreement that began three years ago. At the time, Alpha spent $60,000 to improve the premises. The lease agreement gives Alpha the option to renew the lease for two three-year periods. Alpha began manufacturing pre-fab homes on June 1, 20x2. At that time, it acquired the following:

Accounting amortization in 20x2 amounted to $60,000.

Accounting amortization in 20x2 amounted to $60,000.

Alpha normally acquires raw land, which it then develops into building lots for resale to individuals or housing contractors. In 20x2, it sold part of its undeveloped land inventory to another developer for $400,000. The sale realized a profit of $80,000, which is included in the land-development income above. The proceeds consisted of $40,000 in cash, with the balance payable in five annual instalments beginning in 20x3.

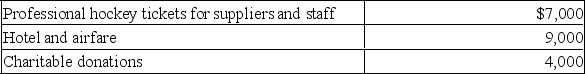

Travel and entertainment expense includes the following:

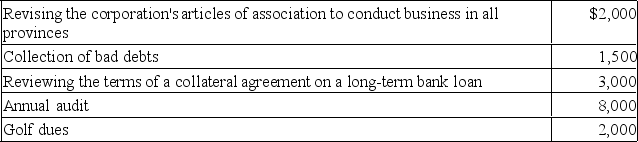

Legal and accounting expense includes the following:

Legal and accounting expense includes the following:

Required:

Required:

Calculate Alpha's net income for tax purposes for the 20x2 taxation year. (Assume 20x2 is 2019.)

Definitions:

Economic Loss

Financial damages not directly resulting from physical harm to a person or property, such as lost profits or earning capacity.

Ethical Competition

The practice of competing fairly and ethically within a market, adhering to moral standards and avoiding practices that harm consumers or competitors.

Physical Contact

The act of touching or being in direct contact with someone or something.

Assaulted

Being subjected to a sudden, violent attack or an attempt to cause physical harm to another person.

Q1: Sarah Green purchased a piece of land

Q2: A taxpayer recognized a $40,000 loss in

Q17: Managerial accounting information generally pertains to an

Q19: This diagram shows balloons of various sizes

Q25: Which of the following structures is heptane?

Q42: Why is water (H<sub>2</sub>O) a liquid at

Q78: Which statement best describes the relationship between

Q92: Which of the following compounds is inorganic?<br>A)

Q102: Which one of the following is not

Q129: Cost of goods manufactured in a manufacturing