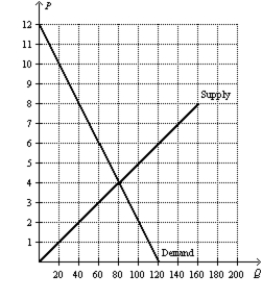

Figure 8-26

-Refer to Figure 8-26.Suppose the government places a $3 tax per unit on this good.How much tax revenue is collected after the tax is imposed?

Definitions:

Negative Net Present Value

An indication that the projected earnings (discounted back to present value) of an investment will be less than the initial investment cost.

Competitor's Cost

The expenses incurred by industry rivals, which can influence competitive pricing strategies.

Required Return

The smallest annual percent yield necessary to convince people or corporations to allocate funds towards a certain security or project.

WACC

Weighted Average Cost of Capital, a calculation of a firm's cost of capital in which each category of capital is proportionately weighted, used to determine the rate of return a company must earn on its existing assets to satisfy its creditors, owners, and other providers of capital.

Q96: Refer to Figure 8-10. Suppose the government

Q129: When motorcycles are taxed and sellers of

Q230: A decrease in the size of a

Q247: All else equal, an increase in demand

Q335: Total surplus in a market will increase

Q357: Which of the following statements is not

Q412: Suppose a tax of $1 per unit

Q427: Refer to Table 7-1. If the price

Q484: Refer to Figure 8-26. Suppose the government

Q523: Refer to Figure 7-20. For quantities less