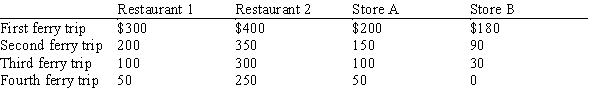

Table 11-5

A small island off the coast of Cape Cod contains two restaurants and two retail stores. Tourists need to take a ferry boat to reach the island, but with a recent slowdown in the economy, tourists are less willing to pay for the boat ride to visit the island. The owners of the restaurants and stores on the island - Restaurants 1 and 2, and Stores A and B - think that if tourists could ride the ferry for free, they would be happy to visit the island, eat and shop. The business owners are considering contributing to a pool of money that will be used to pay for roundtrip ferry service each day. The table represents their willingness to pay, that is, the maximum amount that each business owner is willing to contribute, per day, to pay for each ferry trip.

-Refer to Table 11-5. Suppose the cost to run the ferry for each roundtrip is $500. How many ferry trips should there be to maximize the total surplus of the four business owners?

Definitions:

Revenue Recognition

The accounting principle that outlines the specific conditions under which revenue is recognized and recorded.

Customer Billing

The process of invoicing customers for goods or services provided, detailing the amount owed and payment terms.

Installment Sales Method

An accounting technique that recognizes revenue and expenses from a sale when payments are actually received, rather than at the point of sale.

Realized Gross Profit

The difference between the cost of goods sold and the sales revenue received, specifically referring to profit that has been recognized once a transaction is completed.

Q97: Lump-sum taxes are rarely used in the

Q116: Is a congested nontoll road excludable? Is

Q155: Private markets fail to account for externalities

Q277: A corrective tax is also known as:<br>A)a

Q282: People can be prevented from using a

Q306: When the government intervenes in markets with

Q359: Refer to Table 12-1. Assume that the

Q383: Taxes that are enacted to mitigate the

Q391: Refer to Figure 10-18. What is the

Q440: Refer to Table 12-10. If Jace has