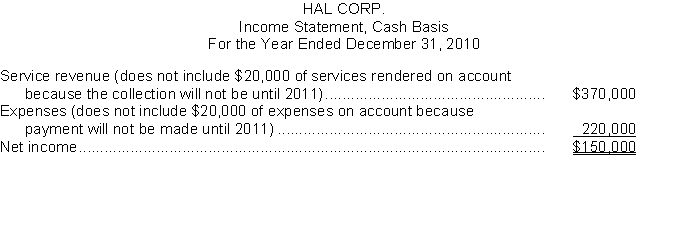

Hal Corp. prepared the following income statement using the cash basis of accounting:

Additional data:

1. Depreciation on a company automobile for the year amounted to $6,000. This amount is not included in the expenses above.

2. On January 1, 2010, paid for a two-year insurance policy on the automobile amounting to $1,800. This amount is included in the expenses above.

Instructions

(a) Recast the above income statement on the accrual basis in conformity with generally accepted accounting principles. Show computations and explain each change.

(b) Explain which basis (cash or accrual) provides a better measure of income.

Definitions:

Process

A series of actions or steps taken in order to achieve a particular end.

Genetic Predisposition

A higher chance of getting a certain disease due to an individual's genetic composition.

Environmental Stress

Physical, chemical, and biological constraints on the productivity and vitality of living organisms due to environmental conditions.

Serotonin

A vital substance in the brain that helps balance emotions and enhance sensations of happiness and overall well-being.

Q27: Match the items below by entering the

Q44: Accountants who are employees of business enterprises

Q90: What is Lamb's 2010 net income using

Q92: The income statement for the year 2010

Q115: Revenues are a subdivision of owner's capital.

Q117: Capital is<br>A) an owner's permanent investment in

Q153: Turner Company collected $6,500 in May of

Q164: CHS Company purchased a truck from JLS

Q181: The body of theory underlying accounting is

Q194: Cost of goods available for sale is