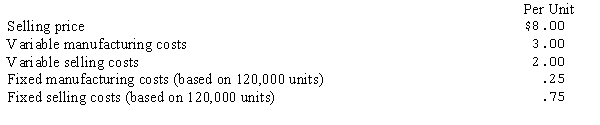

The following data relate to a year's budgeted activity for Jorgensen Corporation, a single product company:  Total fixed costs remain unchanged within the relevant range in which the company is currently operating.

Total fixed costs remain unchanged within the relevant range in which the company is currently operating.

a.What is the projected annual break-even sales in units?

b.What dollar amount of sales would Jorgenson need to achieve operating income of $30,000?

c.If fixed costs increased $7,500, how many more units must be sold to break even?

Definitions:

Income Inequality

The unequal distribution of an economy’s total income among households or families.

Minimum Standard

A predefined level of quality, performance, or capability that products, services, or processes must meet or exceed, often set by regulatory bodies.

Marginal Tax Rate

The marginal tax rate is the percentage of tax applied to your income for each tax bracket in which you qualify, essentially the tax rate on your last dollar of income.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, often aimed at ensuring tax equity.

Q3: An example of an indirect cost that

Q13: Order costs would include all of the

Q22: Consider the budget information for Bert and

Q23: The Kluesner Company started the month of

Q37: Bradley Inc. has the capacity to make

Q50: Bradley Inc. has the capacity to make

Q56: Fixed overhead cost includes all of the

Q91: An investment firm has classified its

Q92: The following data represent the ages

Q149: The interquartile range is found by taking