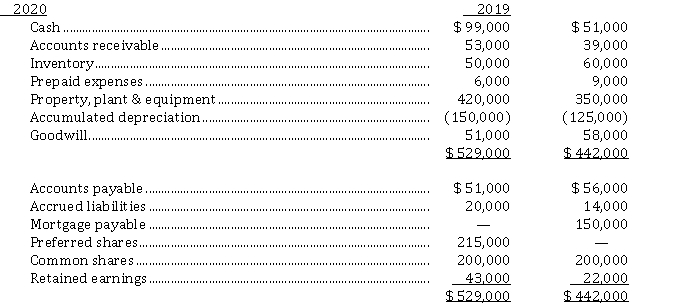

Horse Ltd. has prepared the following comparative statements of financial position at December 31, 2019 and 2020: White Horse adheres to ASPE.

1. The Accumulated Depreciation account has been credited only for the depreciation expense for the year. There were no disposals of property, plant and equipment, but new equipment was purchased during 2020.

2. Depreciation expense and a charge for impairment of goodwill have both been included in operating expenses.

3. The Retained Earnings account was debited for cash dividends declared and paid of $ 46,000, and credited for the net income for the year.

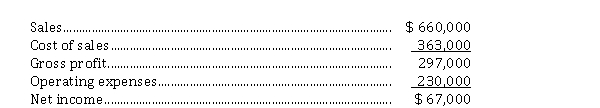

The condensed income statement for 2020 is as follows:  Instructions

Instructions

From the information above, prepare a statement of cash flows (indirect method) for calendar 2020.

Definitions:

Long Term Capital Gain

Profit earned from the sale of an asset held for more than a year, subjected to preferential tax rates.

Tax Bracket

A range of income subject to a particular tax rate under a progressive tax system, where higher income levels are taxed at higher rates.

Inheritance

Assets received from someone who has died, possibly subject to taxes depending on the value and the beneficiary's relationship to the deceased.

Holding Period

The length of time an investment is held by an investor, influencing tax treatment of gains or losses upon disposal.

Q15: Marley Company hired a consultant to help

Q17: A difference between IFRS and ASPE's recognition

Q23: Macbeth Corp.'s comparative statements of financial position

Q27: Casey Inc. uses the accrual method

Q32: Expected annual usage of a particular raw

Q35: What is the total net effect of

Q52: The balance of the defined benefit obligation

Q64: The Mason Corporation budgeted overhead at $240,000

Q92: The difference between the defined benefit obligation

Q123: The total lease-related income recognized by the