Use the following information for questions.

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $ 3,600 was prepaid in 2019 covering the calendar years 2019, 2020, and 2021. This had been debited to insurance expense. In addition, on December 31, 2020, fully depreciated machinery was sold for $ 1,900 cash, but the sale was not recorded until 2021. There were no other errors during 2020 or 2021 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $ 3,600 was prepaid in 2019 covering the calendar years 2019, 2020, and 2021. This had been debited to insurance expense. In addition, on December 31, 2020, fully depreciated machinery was sold for $ 1,900 cash, but the sale was not recorded until 2021. There were no other errors during 2020 or 2021 and no corrections have been made for any of the errors. Ignore income tax considerations.

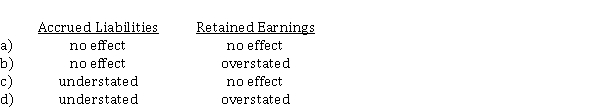

-On December 31, 2020, the bookkeeper at Thrush Corp. did not record special insurance costs that had been incurred (but not yet paid), related to a building that Thrush Corp. is constructing. What is the effect of the omission on accrued liabilities and retained earnings in the December 31, 2020 statement of financial position?

Definitions:

Diuretics

Medications designed to increase urine production to help reduce excess fluid in the body.

Excretory

Pertaining to the process of eliminating waste products from the body's metabolism.

Waste Products

Substances that are produced as byproducts of metabolic processes and need to be eliminated from the body.

Crushing

Compressing or squashing something with force so that it becomes distorted, broken, or compacted.

Q5: To two decimals, Power Corp.'s current ratio

Q7: On a statement of cash flows for

Q35: On January 1, 2020, Marlene Corp. enters

Q43: The entry to apply factory overhead to

Q49: The method of analyzing the behavior of

Q49: Features of a 401(k) plan include all

Q50: Which of the following is NOT considered

Q54: The service life of a building that

Q56: Fixed overhead cost includes all of the

Q68: The Owens Company uses the direct labor