Use the following information for questions.

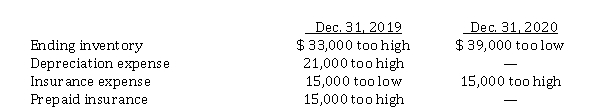

Fairfax Inc. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Fairfax's retained earnings at December 31, 2020 is that the balance is understated by

Definitions:

Smelted

The process of extracting a metal from its ore by heating and melting.

Carload

A shipping term denoting the minimum quantity of cargo required for a shipper to qualify for a reduced rate.

Hormone-Free

Refers to animals raised without the use of growth hormones, often used in reference to meat or dairy products.

Stress-Free

A state or condition where an individual experiences no or minimal stress, leading to a sense of calm and tranquility.

Q22: Night Owl Inc. reports a taxable

Q28: Convertible bonds<br>Miron Construction Ltd. offers five-year, 8%

Q46: Becky Graham earns $15 per hour for

Q46: Calculations for statement of cash flows (indirect

Q46: In a production cost report using process

Q53: Standard setters require the EPS calculation be

Q61: For a manufacturer, manufacturing costs incurred to

Q62: After the observations of cost and production

Q73: Basic earnings per share<br>Assuming there were no

Q103: IFRS 16 disclosure requirements for non-capital leases<br>What