Use the following information for questions.

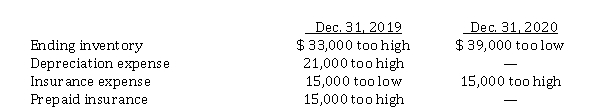

Fairfax Inc. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Fairfax's 2020 net income is

Definitions:

Phenotype

The observable physical or biochemical characteristics of an organism, as determined by both genetic makeup and environmental influences.

Genotype

The genetic makeup of an organism, consisting of all the DNA and genes that contribute to its unique traits.

Somatotype

A classification system for human body types based on physical and physiological characteristics.

Polygenic Trait

A trait influenced by multiple genes, resulting in a wide range of potential outcomes or appearances.

Q2: The following data were taken from Middletown

Q3: All of the following are methods of

Q12: The obligation for a defined contribution plan

Q53: *Hedging<br>List the five steps used to analyze

Q58: On December 31, 2021, 8,000 SARs are

Q60: Which of the following statements is correct?<br>A)

Q61: At issuance, the cash proceeds from the

Q69: Intraperiod tax allocation and disclosure<br>Welyhorsky Inc. presents

Q70: A common reason for issuing convertible bonds

Q75: Under IFRS, if land is the sole