Use the following information for questions.

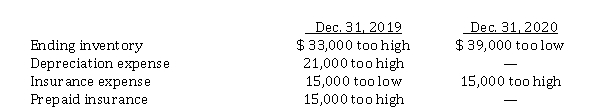

Fairfax Inc. began operations on January 1, 2019. Financial statements for 2019 and 2020 contained the following errors:  In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2020 fully depreciated equipment was sold for $ 7,200, but the sale was NOT recorded until 2021. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Fairfax's working capital at December 31, 2020 is that working capital is understated by

Definitions:

City Centers

Central areas of cities that often contain a concentration of cultural, commercial, and civic activities.

Total Fertility Rate

The average number of children that would be born to a woman over her lifetime under current age-specific fertility rates.

Gender Inequality

The unequal treatment or perceptions of individuals based on their gender, manifesting in different areas such as employment, education, and societal roles.

Crude Death Rate

The number of deaths occurring in a given population, location, or period per 1,000 individuals.

Q1: Problems with interim reporting include<br>A) how to

Q8: Explain the difference between a simple capital

Q13: Effects of errors on financial statements<br>Show how

Q21: Horse Ltd. has prepared the following comparative

Q30: Which of the following statements is INCORRECT?<br>A)

Q32: The cost of production summary for Maha

Q33: The Institute of Management Accountants (IMA) Statement

Q41: Taxes payable method and disclosure<br>Gursol Exchange Inc.,

Q44: For calendar 2020, Melvin Corp. reported depreciation

Q115: On January 1, 2020, Jeckyll Ltd. signs