Use the following information for questions.

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $ 3,600 was prepaid in 2019 covering the calendar years 2019, 2020, and 2021. This had been debited to insurance expense. In addition, on December 31, 2020, fully depreciated machinery was sold for $ 1,900 cash, but the sale was not recorded until 2021. There were no other errors during 2020 or 2021 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $ 3,600 was prepaid in 2019 covering the calendar years 2019, 2020, and 2021. This had been debited to insurance expense. In addition, on December 31, 2020, fully depreciated machinery was sold for $ 1,900 cash, but the sale was not recorded until 2021. There were no other errors during 2020 or 2021 and no corrections have been made for any of the errors. Ignore income tax considerations.

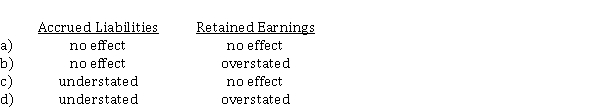

-On December 31, 2020, the bookkeeper at Thrush Corp. did not record special insurance costs that had been incurred (but not yet paid), related to a building that Thrush Corp. is constructing. What is the effect of the omission on accrued liabilities and retained earnings in the December 31, 2020 statement of financial position?

Definitions:

Syphilis

A sexually transmitted infection caused by the bacterium Treponema pallidum, characterized by distinct stages including sores, rashes, and possibly severe medical problems if untreated.

Brain Damage

Physical harm to the brain that impairs its functions, often resulting from accidents, diseases, or medical conditions.

Tertiary Stage

The third stage of some diseases, marked by severe complications and systemic spread, often after a latent period.

Pituitary Gland

A small endocrine gland located at the base of the brain that produces hormones regulating growth, metabolism, and reproduction.

Q6: Which of the following is not a

Q12: Variable overhead costs include all of the

Q13: When the equipment was sold, the Buildings

Q29: Wage plans that encourage employees to work

Q35: Hawkins Company, which uses backflush costing, had

Q37: Diluted earnings per share<br>During 2020, Basenji Corp.

Q60: The personnel involved in the physical control

Q63: For calculating income tax expense, IFRS requires

Q80: Initial direct costs are<br>A) costs incurred by

Q87: Why has accounting for leases been controversial?<br>A)