Use the following information for questions.

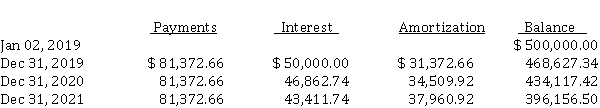

Ball Ltd. purchased land and constructed a service station, at a total cost of $ 450,000. On January 2, 2019, when construction was completed, Ball sold the service station and land to a major oil company for $ 500,000, and immediately leased it back from the oil company. Fair value of the land at the time of the sale was $ 50,000. The lease is a 10-year, non-cancellable lease. Ball uses straight-line amortization for its other assets. The economic life of the station is 15 years with zero residual value. Title to the property will revert back to Ball at the end of the lease. A partial amortization schedule for this lease follows:

-The total lease-related expenses recognized by the lessee during 2020 are (rounded to the nearest dollar)

Definitions:

Automatically Perfected

Refers to a security interest that is deemed perfected without the need for any additional filing or action by the secured party.

Security Interest

A legal claim or right granted over assets as collateral to secure the payment of a debt or performance of some obligation.

Purchase Agreement

A legal document outlining the terms and conditions under which a sale of property will take place.

Financing Statement

A document filed to give public notice to third parties of a secured party's interest in the collateral offered by a debtor.

Q14: At December 1, 2020, Gamma's entry would

Q17: When a corporation agrees to issue common

Q18: Using IFRS, IAS 12 guidelines allow for

Q26: The inventory method which results in the

Q32: Calculate surplus or deficit<br>Sunshine Company calculated its

Q45: The balance in the Common Stock Dividend

Q46: Calculations for statement of cash flows (indirect

Q48: In a lease that is appropriately recorded

Q51: The journal entry to record undamaged direct

Q61: At issuance, the cash proceeds from the