Differences between accounting and taxable income and the effect on future income taxes

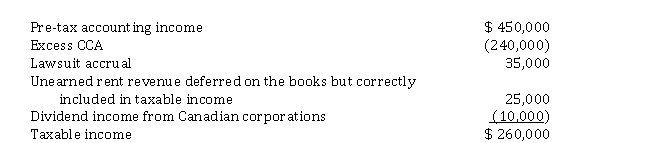

The following differences apply to the reconciliation of accounting income and taxable income of Kulik Inc. for calendar 2020, its first year of operations. The enacted income tax rate is 30% for all years.

1. Excess CCA will reverse equally over a four-year period, 2021-2024.

2. It is estimated that the lawsuit accrual will be paid in 2024.

3. Unearned rent revenue will be recognized as earned equally over a four-year period, 2021-2024.

Instructions

a) Prepare a schedule of future taxable and deductible amounts.

b) Prepare a schedule of any deferred tax asset and/or deferred tax liability.

c) Since this is the first year of operations, there is no beginning deferred tax asset or liability. Calculate the net deferred tax expense (benefit).

d) Prepare the adjusting journal entries to record income tax expense, deferred taxes, and income taxes payable for 2020.

Definitions:

Markup Percentage

The percentage added to the cost price of goods to cover overhead and profit.

Dollar Amount

a numerical value representing a sum of money.

Direct Material

Raw materials that are directly traceable to the manufacturing of a product and are an integral part of the finished product.

Direct Labor

Labor costs directly traceable to the production of specific goods or services, such as wages for assembly line workers.

Q9: Which of the following is NOT generally

Q18: On January 1, 2020, Siamese Inc. redeemed

Q39: Accumulating rights to benefits (for employees)<br>A) are

Q42: Return on plan assets<br>How is the return

Q44: An acceptable method of reporting Treasury Shares

Q51: The book value of the buildings and

Q70: Which of the following transactions would NOT

Q74: Under IFRS, a provision is<br>A) a special

Q75: Total shareholders' equity represents<br>A) a claim to

Q115: On January 1, 2020, Jeckyll Ltd. signs