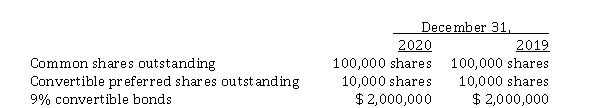

Information concerning the capital structure of Shepherd Corporation follows  During 2020, Shepherd paid dividends of $ 1.00 per common share and $ 2.50 per preferred share. The preferred shares are non-cumulative, and convertible into 20,000 common shares. The 9% convertible bonds are convertible into 50,000 common shares. Net income for calendar 2020 was $ 500,000. Assume the income tax rate is 30%. Basic earnings per share for 2020 is

During 2020, Shepherd paid dividends of $ 1.00 per common share and $ 2.50 per preferred share. The preferred shares are non-cumulative, and convertible into 20,000 common shares. The 9% convertible bonds are convertible into 50,000 common shares. Net income for calendar 2020 was $ 500,000. Assume the income tax rate is 30%. Basic earnings per share for 2020 is

Definitions:

Federal Arbitration Act

A U.S. law that provides for the enforcement of arbitration agreements and allows for the use of arbitration in resolving disputes instead of going to court.

Arbitration Agreement

A contract specifying that disputes will be resolved through arbitration rather than court litigation.

Private Companies

Businesses that are owned by a small number of shareholders or company members, and whose shares are not publicly traded on stock exchanges.

Negotiation

The process of discussing something formally in order to reach an agreement or compromise between parties.

Q20: Basic and diluted earnings per share<br>Barker Inc.

Q20: Retrospective application for accounting changes<br>Discuss how retrospective

Q28: Lee Kim Inc.'s most recent statement of

Q33: The cash provided by investing activities in

Q48: On July 5, 2020, Alpha Corp. purchased

Q51: Calculation of lease amounts for lessor for

Q63: Determine the current service cost for Maggie

Q93: Raphael Inc. provides a defined benefit plan

Q104: For a sales-type lease (ASPE) or manufacturer

Q118: *Treasury shares<br>Zambia Ltd. currently has 150,000 no