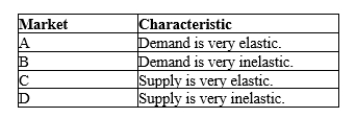

Table 8-1

-Refer to Table 8-1. Suppose the government is considering levying a tax in one or more of the markets described in the table. Which of the markets will allow the government to minimize the deadweight loss(es) from the tax?

Definitions:

Absorption Costing

An accounting method that assigns all manufacturing costs, including both variable costs and fixed overhead, to the production units, making them more expensive on a per-unit basis.

Break-even

The financial point at which revenues exactly match costs, resulting in no net loss or gain.

Product Costs

Costs that are directly associated with the creation of a product, including material, labor, and overhead expenses.

Controllable Costs

Expenses that can be influenced or managed by decisions made by specific managers or departments within an organization.

Q8: When a tax is levied on a

Q34: If the world price of coffee is

Q114: Suppose Russia exports sunflower seeds to Ireland

Q209: Refer to Figure 7-32. At what price

Q240: Refer to Figure 8-11. Suppose Q<sub>1</sub> =

Q312: If Freedonia changes its laws to allow

Q393: Refer to Figure 9-21. With free trade,

Q440: Answer each of the following questions about

Q450: Refer to Scenario 9-2. Suppose the world

Q484: Refer to Figure 9-23. With free trade