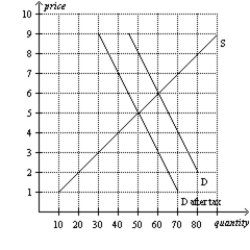

Figure 6-25

-Refer to Figure 6-25.Suppose the same supply and demand curves apply,and a tax of the same amount per unit as shown here is imposed.Now,however,the sellers of the good,rather than the buyers,are required to pay the tax to the government.After the sellers are required to pay the tax,relative to the case depicted in the graph,the burden on buyers will be

Definitions:

Activity-based Management

A management strategy that focuses on optimizing activities to improve the value received by the customer and the profit gained by providing this value.

Waste Elimination

The process of identifying and removing non-value-added activities or materials in a production or business operation to improve efficiency and reduce costs.

Activity-based Costing

An approach to costing that focuses on activities as the fundamental cost drivers, and assigns costs to products and services based on their consumption of these activities.

Manufacturing Overhead Costs

Costs in the manufacturing process that are not directly attributable to the specific product, including equipment maintenance and factory supervision.

Q64: Which of the following is not correct?<br>A)Taxes

Q66: Refer to Table 6-6. If the government

Q212: If the government removes a tax on

Q225: If a tax is levied on the

Q317: If the government levies a $500 tax

Q375: If a nonbinding price floor is imposed

Q380: Refer to Figure 6-33. Suppose a $3

Q528: To say that a price ceiling is

Q531: Suppose that a binding rent control law

Q567: Refer to Figure 6-24. The per-unit burden