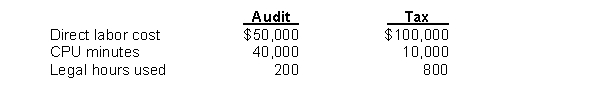

Gant Accounting performs two types of services, Audit and Tax. Gant's overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services is:  Overhead applied to audit services using activity-based costing is

Overhead applied to audit services using activity-based costing is

Definitions:

Average Collection Period

The average number of days it takes for a business to receive payments owed by its customers for sales made on credit.

Receivables Turnover Ratio

The Receivables Turnover Ratio measures how effectively a company collects its outstanding credit, calculated by dividing net credit sales by the average accounts receivable.

Notes Receivable

Financial assets representing amounts owed to a company, payable within a certain period.

Dishonoured

Pertains to a financial instrument, like a check or promissory note, that is not paid upon presentation due to insufficient funds or any other reason for non-payment.

Q5: Which of the following factors would suggest

Q15: At the end of the year, the

Q17: For Buffalo Co., at a sales level

Q21: For purposes of CVP analysis, mixed costs

Q32: Madison Industries has equivalent units of 8,000

Q54: The Nitrogen Fixation Department of Tomco Company

Q78: ABC is particularly useful when product lines

Q122: Determining the unit cost of manufacturing a

Q128: A job order cost system identifies costs

Q136: In a process cost system, total costs