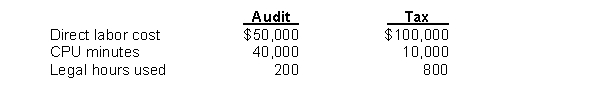

Gant Accounting performs two types of services, Audit and Tax. Gant's overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services is:  Gant Accounting performs tax services for Cathy Lane. Direct labor cost is $1,200; 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using activity-based costing?

Gant Accounting performs tax services for Cathy Lane. Direct labor cost is $1,200; 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using activity-based costing?

Definitions:

Invested Sum

The total amount of money put into a particular investment or project.

Discount Rate

The interest rate used to discount future cash flows to their present value, often used in capital budgeting and investment planning.

Lease Payments

Regular payments made by a lessee to a lessor for the use of an asset for a specific period of time.

Profitability Index

A financial ratio that measures the return on investment for a project by dividing the present value of future cash flows by the initial investment.

Q6: At the end of the year, underapplied

Q16: Total units to be accounted for less

Q38: Montoya Manufacturing has fixed costs of $3,000,000

Q40: It is necessary to calculate equivalent units

Q50: Activity-based management focuses on reducing costs and

Q63: Sanders Company has two production departments: Fabricating

Q108: A process cost accounting system is most

Q111: Cotter pins and lubricants used irregularly in

Q139: The cost of raw materials purchased is

Q175: Physical units accounted for are 160,000. Total