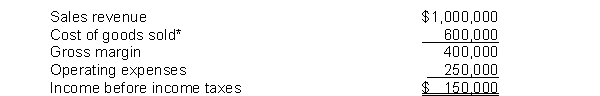

Vance Company reported the following summarized annual data at the end of 2018:

*Based on an ending FIFO inventory of $250,000.

The income tax rate is 40%. The controller of the company is considering a switch from FIFO to LIFO. He has determined that on a LIFO basis, the ending inventory would have been $180,000.

Instructions

(a) Restate the summary information on a LIFO basis.

(b) What effect, if any, would the proposed change have on Vance's income tax expense, net income, and cash flows?

(c) If you were an owner of this business, what would your reaction be to this proposed change?

Definitions:

Gross Margin Ratio

A financial ratio that measures a company's financial health, calculated by subtracting the cost of goods sold from net sales and dividing by net sales.

Sales Revenue

The total amount of money received by a company from sales of goods or services before any expenses are subtracted.

Cost of Goods Sold

Expenses specifically related to producing the merchandise a company markets.

Acid-test Ratio

A financial metric that measures a company's ability to pay off its current liabilities with its quick or liquid assets.

Q27: Match the internal control principle below with

Q36: Eneri Company's inventory records show the following

Q49: If a company has no beginning inventory

Q70: A company maintains the asset account, Cash

Q129: Accrued revenues are revenues which have been

Q166: Vance Company reported the following summarized annual

Q181: Accountants believe that the write down from

Q195: Which of the following are also called

Q202: A company stamps checks received in the

Q205: Candy Claws Company gathered the following reconciling