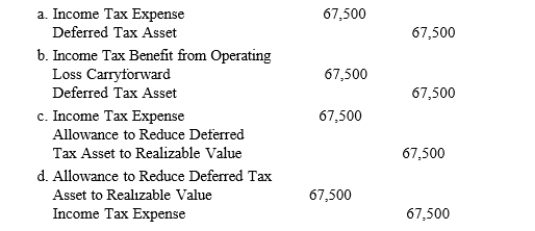

During its first year of operations, 2016, the Cocoa Company reported both a pretax financial and a taxable loss of $300,000. The income tax rate is 30% for the current and future years. Due to a sufficient backlog of sales orders, Cocoa did not establish a valuation allowance to reduce the $90,000 deferred tax asset. However, early in 2017, one major customer, representing 60% of the 2017 year-end sales backlog, went bankrupt. Cocoa now believes that it is more likely than not that 75% of the deferred tax asset will not be realized. The entry to record the valuation allowance would be

Definitions:

Positive Punishment

The addition of an undesirable stimulus to decrease a behavior, such as adding chores for breaking rules.

Texting

The act of sending and receiving short written messages via mobile phone.

Unpleasant Stimulus

An external factor that causes discomfort or displeasure, often used in psychological experiments to provoke a response.

Withdrawal

The discomfort and distress that follow discontinuing an addictive drug or behavior.

Q3: When multiple service-related performance obligations exist within

Q18: Donner Construction enters into a contract with

Q22: In most states, it is illegal to

Q28: ERISA Pension Reform Act of 1974) provides

Q31: Dividends in arrears pertain to .<br>A) non-cumulative

Q38: Selected accounting information regarding the Chime Corporation

Q59: In 2017, Dygress Construction Co. began work

Q66: A company should only apply the revenue

Q75: A simple capital structure consists of<br>A) only

Q113: In which of the following situations will