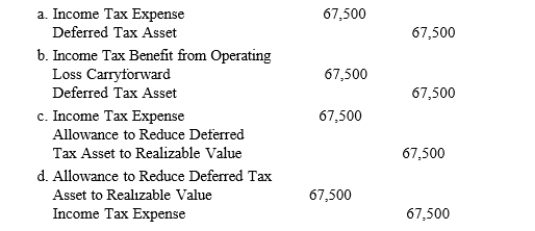

During its first year of operations, 2016, the Cocoa Company reported both a pretax financial and a taxable loss of $300,000. The income tax rate is 30% for the current and future years. Due to a sufficient backlog of sales orders, Cocoa did not establish a valuation allowance to reduce the $90,000 deferred tax asset. However, early in 2017, one major customer, representing 60% of the 2017 year-end sales backlog, went bankrupt. Cocoa now believes that it is more likely than not that 75% of the deferred tax asset will not be realized. The entry to record the valuation allowance would be

Definitions:

Feminists

Advocates for women's rights and equality between the genders, aiming to dismantle systemic inequalities and social norms limiting women's roles.

Woman Movement

A series of campaigns for reforms on issues such as reproductive rights, domestic violence, maternity leave, equal pay, women's suffrage, and sexual harassment, broadly known as the feminist movement.

Gender-Group Unity

The solidarity and collective identity formed among individuals based on their shared gender experiences or goals, often in the context of seeking social equality or rights.

Moral Purity

The state of being free from moral fault or corruption, often emphasized in religious or ethical contexts.

Q8: Disclosures for a defined benefit pension plan

Q26: On July 10, Boogie Footware agrees to

Q54: Which of the following bonds pay no

Q60: On January 1, 2003, Plentiva Company signed

Q70: At the end of the current year,

Q73: Which of the following items would not

Q83: The FASB requires the use of the

Q85: Interperiod tax allocation is required for all

Q87: Several years ago, Walther, Inc. issued 12,000

Q123: Shares of capital stock issued to and