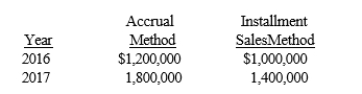

On January 1, 2016, Bedrock Company began recognizing revenues from all sales under the accrual method for financial reporting purposes and under the installment sales method for income tax purposes. Bedrock reported the following gross margin on sales for 2016 and 2017:  The enacted tax rate for both 2016 and 2017 was 30%. Assuming there are no other temporary differences, 2017 what is the amount of deferred tax liability that Bedrock should report on its December 31, 2017 balance sheet?

The enacted tax rate for both 2016 and 2017 was 30%. Assuming there are no other temporary differences, 2017 what is the amount of deferred tax liability that Bedrock should report on its December 31, 2017 balance sheet?

Definitions:

Audit Log

A record that tracks the sequence of activities or changes in a system, often used for security and compliance purposes.

Transaction Journal

A detailed record showing all the financial transactions of a business, used for accounting and auditing purposes.

Internal Control

Processes and procedures implemented by a company to ensure integrity of financial and accounting information, promote accountability, and prevent fraud.

Management Reports

Comprehensive analyses and summaries of financial and operational data, prepared for internal management use.

Q1: Temporary differences cause a company's effective tax

Q10: The Roberts Company reported net income of

Q24: Revenue is recognized for accounting purposes when

Q41: A corporation must recognize a valuation allowance

Q42: Under the if-converted method, the impact of

Q57: For reporting operating cash flows under the

Q84: Which of the following methods should be

Q88: Port Deposit, Inc. reports the following deferred

Q91: An advantage of retrospective adjustment method is

Q178: Bond interest expense is calculated as the