Moover Construction enters into a contract with a customer to build a warehouse for $900,000 on June 30, 2017, with a performance bonus of $60,000 if the building is completed by October 31, 2017. The bonus is reduced by

$20,000 each week that completion is delayed. The contract also states that if the warehouse receives a favorable safety inspection rating from government inspectors by November 30, Moover will receive a performance bonus of

$40,000.

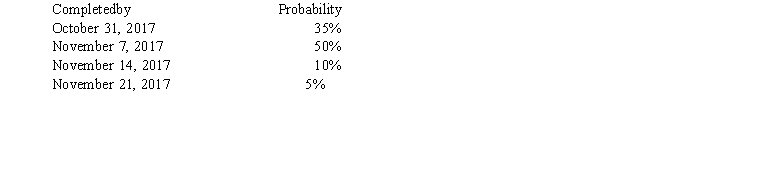

Moover commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes:  In addition, Moover estimates there is a 90% chance that the warehouse will receive a favorable safety inspection rating upon timely completion.

In addition, Moover estimates there is a 90% chance that the warehouse will receive a favorable safety inspection rating upon timely completion.

Required:

a. Assume Moover uses the expected value approach. Determine the transaction price for this transaction.

b. Assume Moover uses the most likely amount approach. Determine the transaction price for this transaction.

Definitions:

GDP Deflator

An appraisal method for the prices of all newly developed, domestically produced, consumable goods and services in an economy.

Real GDP

Real GDP measures the value of all final goods and services produced within a country in a given period of time, adjusted for inflation, providing a more accurate picture of an economy's size and how it's growing over time.

GDP Deflator

An economic metric that converts output measured at current prices into constant-dollar output by adjusting for inflation.

Nominal GDP

Gross Domestic Product measured in current prices without adjusting for inflation, representing the total value of all goods and services produced over a specific time period within a country's borders.

Q5: TradeWell Company signs a lease agreement for

Q10: If a contract involves a significant financing

Q10: An operating loss carryforward occurs when<br>A) prior

Q36: The lessee should report capital lease obligations

Q41: On January 1, 2016, Denise Company signed

Q45: On January 1, 2016, Watson Company signed

Q75: On January 1, Maxine Corp. entered into

Q83: On January 1, 2016, a corporation had

Q90: What four alternative methods for accounting for

Q123: Shares of capital stock issued to and