Exhibit 11-05

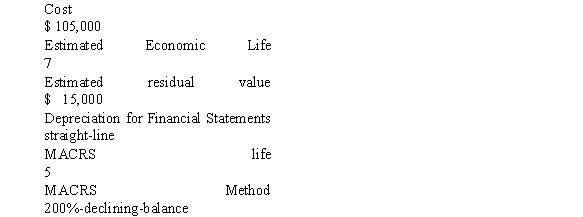

Wilson is preparing his tax returns using the MACRS convention. The following information relates to the purchase of an asset on January 1, Year 1.

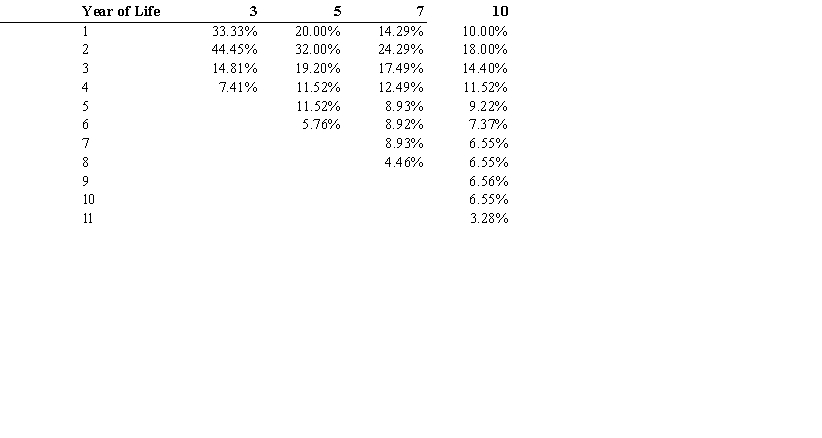

MACRS Depreciation as a Percentage of the Cost of the Asset

-Refer to Exhibit 11-05, what amount of depreciation would be recorded on the income tax returns for year 3?

Definitions:

Q27: Discount on Notes Payable should be classified

Q30: Using a periodic inventory system, Bertram Company

Q37: Which of the following characteristics is not

Q42: Fish Galore Corp. bought 25% of Fin

Q69: Which of the following statements regarding the

Q74: Assume that a company is facing a

Q106: After the auditors counted the inventory of

Q114: Which of the following sets represents a

Q129: Refer to Exhibit 11-05, what amount of

Q168: A $700,000, 20-year, 8% bond issue was