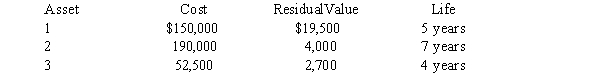

On January 1, 2015, the Wintergreen Co. acquired three assets that it intends to combine into a single account and depreciate using the composite depreciation straight-line) method. The assets have the following characteristics:  Required:

Required:

a. Determine the composite rate for depreciation of these assets.

b. Why did Wintergreen Co. use a composite rate than a group depreciation rate?

Definitions:

Time

The indefinite continued progress of existence and events in the past, present, and future regarded as a whole.

Condition

A specific requirement or stipulation that affects or determines the outcome or validity of a legal agreement.

Sum Certain

A fixed or determined amount of money specified in a legal document that is not subject to any conditions or contingencies.

Negotiable

Capable of being transferred or modified through discussion or upon reaching an agreement.

Q6: Under special circumstances GAAP allows a company

Q20: On January 1, 2017, Waters Corp. bought

Q33: Information concerning a mine is as follows:

Q36: Under the dollar-value LIFO the cost-to-retail ratio

Q41: Mary Co. exchanged a piece of equipment

Q62: Wayne Co. purchased $40,000 of equipment with

Q67: Pope, Inc. has life insurance policies on

Q99: On January 1, 2015, the Jones-Smith Corp.

Q130: When a long-term non-interest-bearing note is exchanged

Q187: How is the stated interest rate on