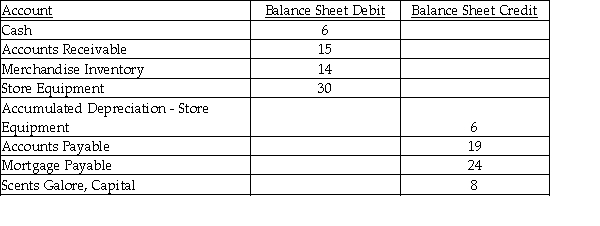

The following accounts are on the Balance Sheet section of Scents Galore worksheet for the date November 30, 201X. Please prepare a Classified Balance Sheet using the information below.

Additional information: Withdrawals for the period are $4, and Net Income is $12.

Definitions:

Product Availability

The extent to which a product can be purchased or obtained at the time a customer is ready to buy.

Bullwhip Effect

A phenomenon in supply chains where small fluctuations in consumer demand cause progressively larger fluctuations in demand at wholesalers and manufacturers.

Boom And Bust Cycles

Economic phases characterized by periods of rapid expansion (boom) followed by periods of decline (bust), often due to supply and demand imbalances.

CPFR

Collaborative Planning, Forecasting, and Replenishment is a business practice where trading partners use joint business planning and a shared forecast to optimize supply chain efficiency.

Q3: Under the perpetual inventory system, in addition

Q33: Prepare the necessary general journal entry for

Q36: Sterling Supply uses a periodic inventory system.

Q55: Companies that feel aging is too time-consuming

Q64: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q64: A characteristic of Merchandise Inventory is:<br>A) it

Q75: The account for Payroll Tax Expense includes

Q102: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q110: Journalize the Nov. 7 transaction.<br>_ _ _<br>_

Q122: Lois's Furniture uses a periodic inventory system.