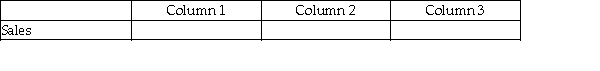

For each of the following, identify in Column 1 the balance the account will have in the adjusted trial balance columns (debit or credit), in Column 2 the financial statement column(s) in which the account balance will be found (income statement or balance sheet), and in Column 3 the effect the account will have on the determination of net income (increase, decrease, or none).

-

Definitions:

Leased Equipment

Assets obtained for use by leasing rather than purchasing, allowing companies to use equipment without owning it.

Depreciation Expense

The allocated amount of the cost of an asset expensed each period over its useful life, reflecting wear and tear or obsolescence.

Rent Expense

Rent Expense is the cost incurred by a company or individual for the use of a property or equipment.

Capital Lease

A lease agreement that is classified as a purchase of an asset for accounting purposes, as it meets specific criteria set out in accounting standards.

Q15: Adjustments are journalized before recording them in

Q44: The following accounts are on the Balance

Q47: An employee has gross earnings of $1,100

Q62: In which section does Interest Revenue appear

Q63: From the following items, which would most

Q81: Assume that in Year 1, the ending

Q83: A deposit must be made when filing

Q84: Under the periodic inventory system, an adjustment

Q103: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q120: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"