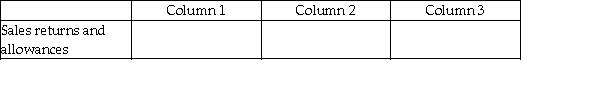

For each of the following, identify in Column 1 the balance the account will have in the adjusted trial balance columns (debit or credit), in Column 2 the financial statement column(s) in which the account balance will be found (income statement or balance sheet), and in Column 3 the effect the account will have on the determination of net income (increase, decrease, or none).

-

Definitions:

Strategic Planning

The procedure of defining a business's direction and making decisions on allocating its resources to pursue this direction.

Convert Weaknesses

Convert Weaknesses is a strategic approach aimed at identifying and transforming limitations or disadvantages of a business into strengths or competitive advantages.

Key Threats

Primary external challenges or obstacles that could negatively impact an organization's ability to achieve its strategic objectives.

Limitations

Restrictions or constraints that impact the scope, effectiveness, or outcomes of a project, research study, or business strategy.

Q23: Prepare the necessary general journal entry for

Q24: Discounts on purchases are not taken on

Q44: The following accounts are on the Balance

Q54: Secret Trails received payment in full within

Q70: A company paid next month's rent in

Q84: Before the accounts are adjusted and closed

Q89: Home Restoration reports net sales of $70,000.

Q111: The amount found in the Income Statement

Q124: If a customer returns merchandise, the income

Q135: A calendar quarter consists of:<br>A) 13 weeks.<br>B)