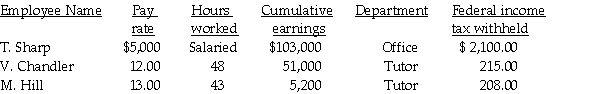

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total gross earnings for the office.

Definitions:

Corporate Formalities

The procedures, rules, and policies that a corporation must follow to ensure legality and protect its shareholders.

Annual Meeting

A yearly gathering of the members or shareholders of an organization to discuss its performance, elect leadership, or make decisions on corporate issues.

Directors

Directors are individuals elected to a corporation's board to oversee and guide the organization's policies and direction.

Fiduciary Duty

A legal obligation of trust requiring an individual to act in the best interests of another party, often seen in the context of trustees, guardians, and financial advisors.

Q16: The Schedule of Accounts Payable is listed

Q23: To close the Fees Earned account:<br>A) debit

Q26: The post-closing trial balance is used to

Q38: Net pay is equal to gross pay

Q42: Compute net earnings on March 3, when

Q55: Beginning inventory was $3,600, purchases totaled $20,200

Q62: Define and compare the accounts receivable subsidiary

Q68: Pam received $1,800 for working 40 hours.

Q69: When a business starts, what must it

Q116: Net Sales equals Gross Sales - Sales