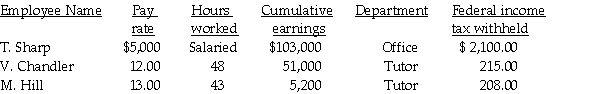

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Definitions:

Borderline Personality Disorder

A mental health disorder characterized by unstable moods, behavior, and relationships, with symptoms often including emotional instability, feelings of worthlessness, insecurity, and impulsivity.

Reduced Awareness

A state or condition in which an individual's perception and recognition of external stimuli are decreased.

Wild Mood Swings

Rapid and intense changes in emotional state without a clear cause.

Hallucinations

Perceptions in the absence of external stimuli that have qualities of real perception, often experienced in auditory or visual forms.

Q37: Santa Materials sold goods for $3,200 plus

Q39: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7147/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q50: Prepare the general journal entry to record

Q51: Closing entries will affect:<br>A) total assets.<br>B) Cash.<br>C)

Q53: To record accrued salaries, you would:<br>A) debit

Q65: To show that you have posted to

Q94: Which of the following statements is true?<br>A)

Q98: Why are the employee deductions recorded as

Q100: As accumulated depreciation is recorded, the net

Q119: J. Oakely showed a net loss of