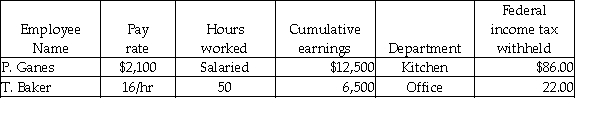

Grammy's Bakery had the following information for the pay period ending June 30:  Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

Assume: FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.)

Definitions:

Production

The method of merging different materials and non-material elements (such as designs and expertise) to create products for use.

The Wealth of Nations

"The Wealth of Nations" is a seminal book by Adam Smith, where he examines the nature and causes of the wealth of nations, laying the foundations of classical economics.

Adam Smith

A Scottish economist and philosopher, considered the father of modern economics, best known for his work "The Wealth of Nations."

Efficient

The characteristic of maximizing output or effectiveness with the least waste of time, resources, or effort.

Q1: The entry to close the Fees Earned

Q15: Information to prepare W-2 forms can be

Q39: On June 15, Melo Park purchased merchandise

Q56: Endorsing a check:<br>A) guarantees payment.<br>B) transfers the

Q67: Compute the total deductions.

Q90: Compute the total gross earnings.

Q92: The payroll taxes the employer is responsible

Q111: An important function of the worksheet is

Q115: If ending inventory is overstated this period,

Q117: Which tax does NOT have a wage